Managing money can be a challenging task for many people, especially when faced with bills, unexpected expenses, and other financial obligations. However, having a solid budgeting plan in place can make all the difference. Budgeting is the process of creating a plan for how you will spend your money, ensuring that you have enough money to cover your expenses and save for the future. By taking the following steps in creating a budget, you can gain control over your finances, achieve your financial goals, and reduce financial stress.

Assess your income sources

Assessing your income sources is an essential step towards achieving financial stability and success. Understanding how much money you earn, where it comes from, and how it is taxed can help you create a solid financial plan and achieve your goals. Assessing your income sources involves taking a comprehensive look at all the ways you earn money, including your primary job, side hustles, investments, and other sources of income. This process can help you identify opportunities for growth, maximize your earnings, and minimize your tax liability. By taking the time to assess your income sources, you can make informed decisions about your finances and take control of your financial future.

Assess your expenses

Assessing your expenses is an essential part of managing your finances and achieving financial stability. When you know where your money goes each month, you can create a realistic budget, prioritize your spending, and identify areas where you can cut back. This process can help you build a healthy financial foundation, reduce stress, and ultimately achieve your financial goals.

Assessing your expenses involves taking a comprehensive look at all the money you spend. This includes fixed expenses like rent or mortgage payments, utilities, and insurance, as well as variable expenses like groceries, entertainment, and travel. One way to assess your expenses is to review your bank and credit card statements from the past few months. Look for recurring expenses and compare them to your income to determine what percentage of your income goes towards each expense category. This will help you see where your money is going and identify any areas where you may be overspending.

Once you have a clear understanding of your expenses, you can create a budget that reflects your priorities and goals. This budget should include all of your expenses and also allocate some money towards savings and debt repayment. By setting a budget, you can avoid overspending and make informed decisions about your purchases. Additionally, tracking your expenses and sticking to your budget can help you build good financial habits and stay on track towards your financial goals.

Assessing your expenses can also help you identify areas where you can cut back and save money. For example, you may find that you’re spending more on dining out than you realize, or that you’re paying for subscription services you don’t use. By making small adjustments to your spending habits, you can free up more money to put towards your financial goals.

In addition to helping you manage your finances, assessing your expenses can also help you identify potential areas of financial risk. For example, if you have significant debt or expenses that are close to or exceed your income, you may be at risk of financial instability. By identifying these areas, you can take steps to address them and work towards a more secure financial future.

Stick with a budget

Creating a budget is an essential step in taking control of your finances and achieving your financial goals. However, sticking to a budget can be a challenge for many people. It requires discipline, consistency, and a willingness to make changes to your spending habits and daily life. Luckily, there are steps that we’ll discuss that you can take to help improve the likelihood that you will follow your self-imposed guidelines and achieve your goals that you’ve hopefully kept in mind through the entire process.

- Have a financial goal. Setting financial goals is essential in staying motivated and committed to your budget. Whether you’re saving for a down payment on a house, paying off debt, or building an emergency fund, having specific financial goals can help you stay focused on your budget. Sticking to any method without a concrete purpose is bound to fail without something driving you forward.

- Your budget must be realistic. If your budget is too restrictive or unrealistic, you are more likely to abandon it or feel frustrated. Make sure your budget takes into account all of your expenses, including bills, groceries, and entertainment. If you’re making a monthly budgeting plan, make sure to include a breakdown of annual or quarterly payments so it’s not a shock when that bill arrives. Use your past spending habits as a guide to help you create a budget that is reasonable and achievable.

- Develop a way to track your expenses. You need to know where your money is going. Tracking your expenses can help you identify and expose areas where you can cut back and make adjustments to your budget. There are many tools available to help you track your expenses, including budgeting apps, spreadsheets, and pen and paper. Whatever method you choose, make sure you are tracking all of your expenses, including small purchases like coffee or snacks. Tip: many banking apps will have a breakdown of categories in which your money is going which is a helpful tool that may requires little to no work on your end.

- Plan for irregular expenses or expenses that are out of your control. When creating a budget, it’s easy to overlook irregular expenses that don’t occur on a regular basis. However, these expenses can throw off your budget if you’re not prepared for them. Examples of irregular expenses include car repairs, medical bills, or unexpected travel expenses. To avoid getting caught off guard, it’s essential to set aside a portion of your budget for irregular expenses. This can be done by creating a separate category in your budget for irregular expenses as savings and setting aside a specific amount each month. Having a cushion for unexpected expenses can help you stay on track with your budget and avoid dipping into your emergency fund or credit cards.

- Automate your savings. Automating your savings can be a great way to guarantee you’re sticking to your budget. Set up automatic transfers from your checking account to your savings account each month or set up two separate paychecks from your employer each pay period if possible. This will help you save money consistently without having to think about it. Having a dedicated savings account can also help you reach your financial goals faster. For example, if you’re saving for a down payment on a house or a new car, having a dedicated savings account can make it easier to track your progress and avoid the temptation to dip into your savings for other expenses. Tip: High-yield savings accounts are helpful ways to put your money to work while being immediately available to you when necessary.

- Use budgeting apps and technology. It’s 2023 folks. The amount of technology at your convenience to help improve your budget is available and abundant. Budgeting apps can be a great tool to help you stick to your budget. There are many apps available that can track your spending, categorize your expenses, and provide you with budgeting tips. These apps can also send you notifications when you’re approaching your spending limits or when bills are due. Some popular budgeting apps include Mint, YNAB, and Personal Capital. Using these apps can help you stay on top of your budget and make adjustments as needed.

- Celebrate your successes. You made it! Sticking to a budget can be challenging, but it’s essential to celebrate your successes along the way. When you reach a financial milestone or achieve one of your goals, take the time to celebrate your accomplishment. This can help you stay motivated and committed to your budget. Celebrating your successes doesn’t have to be expensive. You can treat yourself to a favorite meal or activity, or simply take a moment to reflect on your progress and give yourself a pat on the back!

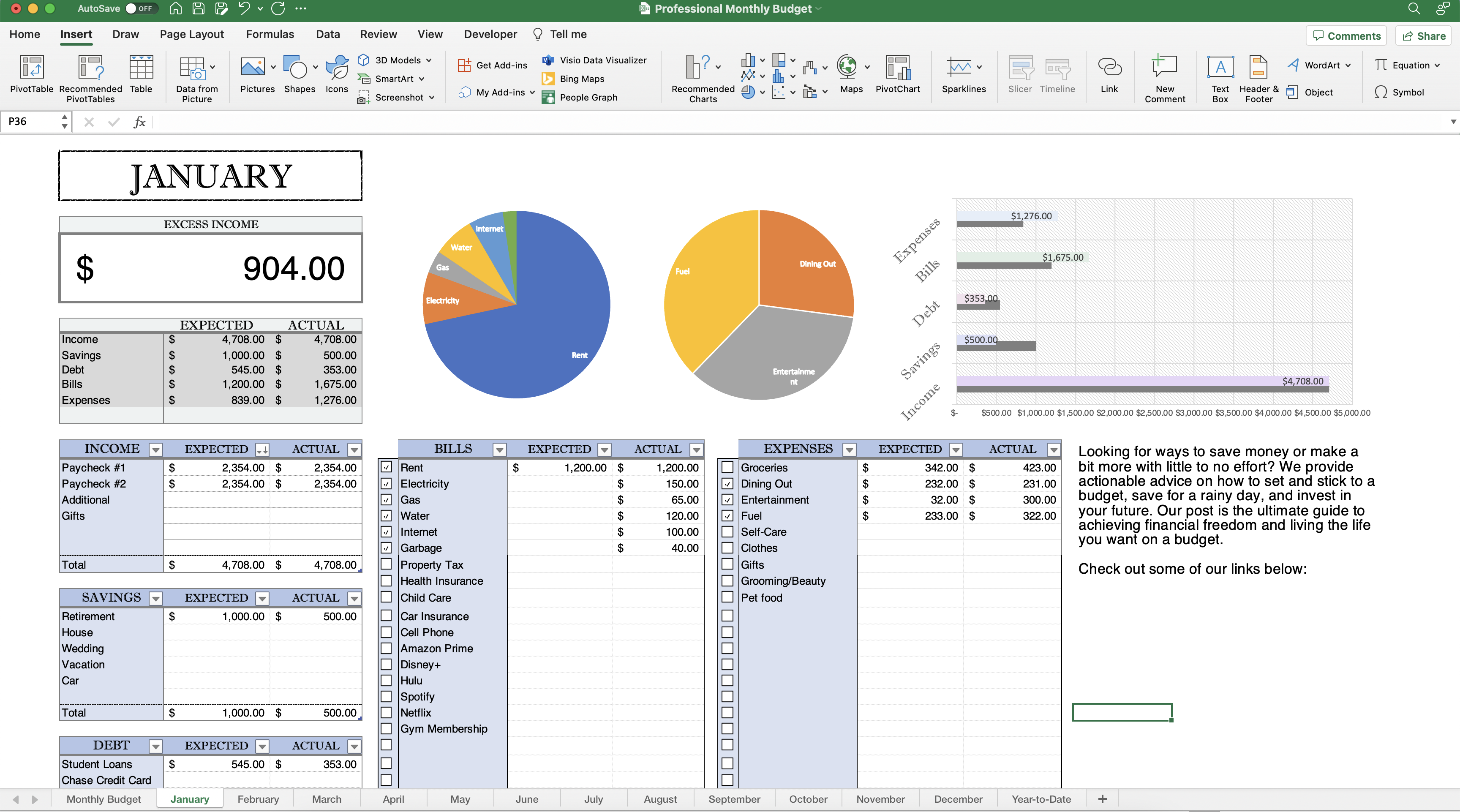

BONUS: A spreadsheet is a great way to track your expenses and visually be able to see the impact of certain expenses over others or the grand scheme of your financial situation. They’re a helpful tool but can take some time to create one that encompasses everything that you would want or need. We’ve made one HERE that is simple and interactive to use just for you!

Use those savings !

Now that you have some money set aside, you may be wondering what to do with it. The good news is that there are many options available to you, depending on your financial goals and risk tolerance. You can use your savings to invest in the stock market, put it into a savings account or a certificate of deposit (CD) for safekeeping, pay off debt, or use it towards a down payment on a home. Whatever you decide to do with your savings, it’s important to have a plan and consider your options carefully. By making informed decisions about your money, you can set yourself up for a secure financial future. For instance, it may be more beneficial to invest your money than aggressively paying off debt if the return is higher than the accumulate interest. If the debt is due to credit cards which typically has a high APR, it will be in your best interest to pay them off first. Consider a scenario that earns or saves you the most money as possible in the long term.

Search our blog in the future for a more detailed guide in distributing your money to best set yourself up for the future.

Leave a comment